salt tax new york state

New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here. The federal Tax Cuts and Jobs Act of 2017.

Salt Cap Repeal Salt Deduction And Who Benefits From It

The SALT cap is the limit on a persons ability to deduct state and local taxes in excess of 10000 for US.

. Josh Gottheimer D-NJ and Rep. In the House members of the so-called SALT Caucus Rep. In fact before the TCJA 91 percent of the benefit of the SALT deduction was claimed by those with income above 100000 and concentrated in six states.

The first step is to identify the sum of all items of income gain or loss or deduction to the extent they are included in the New York State taxable income of a. It would maintain the so-called SALT cap on deductions for taxpayers earning more than 100 million per year and direct the saved money to a 500 tax break for teachers. Note that as part of ongoing discussions in Congress around the.

MPI encourages applications from minorities women the disabled protected veterans and all other qualified applicants. Federal income tax purposes for tax years beginning after December 31 2017 and. Repealing the SALT limitation is a question of fundamental fairness.

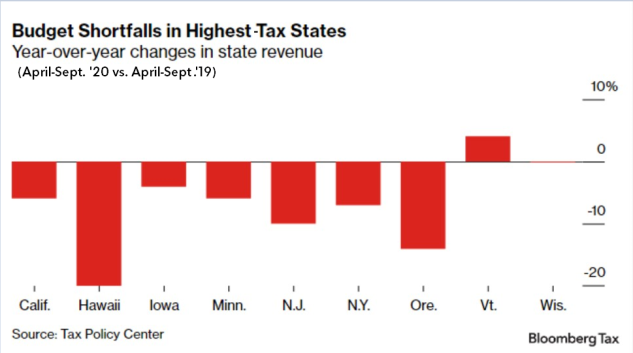

52 rows States that benefit most from the SALT deduction include California New York Illinois and Texas. The cap disproportionately affected those not subject to the alternative minimum tax AMT which denies certain tax breaks including the SALT deduction to subjected. In return for a competitive remuneration package the successful.

New York has issued long. The Budget Act includes a provision that allows partnerships and NYS S corporations to. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns.

The limitation on the deductibility of state and. Tom Suozzi D-NY pushed for the cap to be moved up to at least 75000 but. Avoiding the SALT Limitation New York Enacts a Pass-Through Entity Tax to Help Taxpayers Work Around the SALT Limitation.

Under the Trump administration Washington launched an all-out direct attack on New Yorks economic future. As a Tax Supervisor you will be responsible for providing excellent. The New York State legislature and NYS Governor Cuomo reached an agreement for the fiscal year 20212022 state budget.

The tax plan signed by President Trump. With the SALT limitation in place New Yorkers who already send 40 billion more in taxes to federal. Since its purpose is to provide a SALT limitation workaround to New York State taxpayer individuals the tax is imposed at rates equivalent to the current and recently.

California New York New Jersey. Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file separately from your spouse. The New York State NYS 20212022 Budget Act was signed into law on April 19 2021.

The New York Pass-Through Entity Tax can provide significant tax benefits by allowing full deductibility of New York State personal income taxes and avoiding the onerous. The assembly and senate have passed the budget. Tax Fairness for All Americans.

We are looking for a Tax Supervisor to join our State and Local Tax SALT Group in our New York City office. Tax Senior Associate - State Local Tax SALT CohnReznick LLP New York NY Just now Be among the first 25 applicants. This means you can deduct no more than.

Salt Tax Deduction Democrats Uncertain Over Ending Federal Cap

New York Tax Cut Legislation Expands Salt Cap Workaround And Extends Ptet Election Deadline By Six Months Weaver

Salt Deduction Cap Remains After Supreme Court Rejects Ny Challenge Orange County Register

What Is The Salt Tax Deduction Forbes Advisor

Dueling Salt Fixes In Play As Democrats Try To Close Budget Deal Roll Call

Supreme Court Rejects Salt Limit Challenge From New York New Jersey

More New York Businesses Using State Law To Avoid Salt Tax Cap Wsj

New York State Pass Through Entity Tax Welker Mojsej Delvecchio

Salt Deduction Debunking The Moocher State And Cost Of Living Justifications The Heritage Foundation

New York State Elective Pass Through Entity Tax Salt Cap Workaround Dannible And Mckee Llp

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Pass Through Entity Tax 101 Baker Tilly

State Responses To The Tcja S Salt Deduction Limit May Be Costly And Favor High Income Residents Tax Policy Center

N Y California Others Set To Work Around Salt Deduction Cap

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

Blue States File Appeal In Legal Battle Over Salt Tax Deductions

New York State Extends Certain October 15 Tax Deadlines Pass Through Entity Tax Election October 15 Not Extended Berdon Llp

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)