iowa state income tax calculator 2019

Missouri has nine marginal tax brackets ranging from 15 the lowest Missouri tax bracket to 54 the highest Missouri tax bracket. Unlike the Federal Income Tax Pennsylvanias state income tax does not provide couples filing jointly with expanded income tax brackets.

State Corporate Income Tax Rates And Brackets Tax Foundation

Start tax preparation and filing taxes for 2019 with HR Block 2019 Back Editions.

. Choose any state from the list above for detailed state income tax information including 2022 income tax tables state tax deductions and state-specific income tax calculators. If you want to compare all of the state tax rates on one page visit. Texas has no state-level income taxes although the Federal income tax still applies to income earned by Texas residents.

But there are a few ways to get your state income tax returns done for free and in this article I am showing you free file programs that I found. And of course Washington DC. And it did so again for the 2019 and 2020 tax years.

Heres what you need to know about the Illinois state income tax from the states flat tax rate to available deductions credits and exemptions. How to File Your State Tax Return for Free. Pennsylvanias maximum marginal income tax rate is the 1st highest in the United States ranking directly below Pennsylvanias.

As you have probably noticed many places offer a free filing of a Federal return but dont offer free state filing. Arizona collects income taxes from its residents in five brackets and in 2006 lowered its tax brackets across the board. Extension for FarmersFisherman to File and Pay 2021 Iowa Income Tax Returns.

Pennsylvania collects a state income tax at a maximum marginal tax rate of spread across tax brackets. You may check the status of your refund on-line at Massachusetts Tax CenterYou can start checking on the status of your return within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return. Youll need your social security number filing status zip code and the tax year 2014.

1 9 Tax credit projects located in a rural area as defined in section 520 of the Housing Act of 1949 are eligible to use the greater of area median gross income or national non-metropolitan median income as allowed under the Housing Act of 2008 for rent and income determinations after the July 30th enactment date of the Housing Act of 2008. The Iowa Department of Revenue has released new state sales and use tax guidance regarding proposed Sales. IDR has issued new income withholding tax tables for 2022 including an updated withholding calculator.

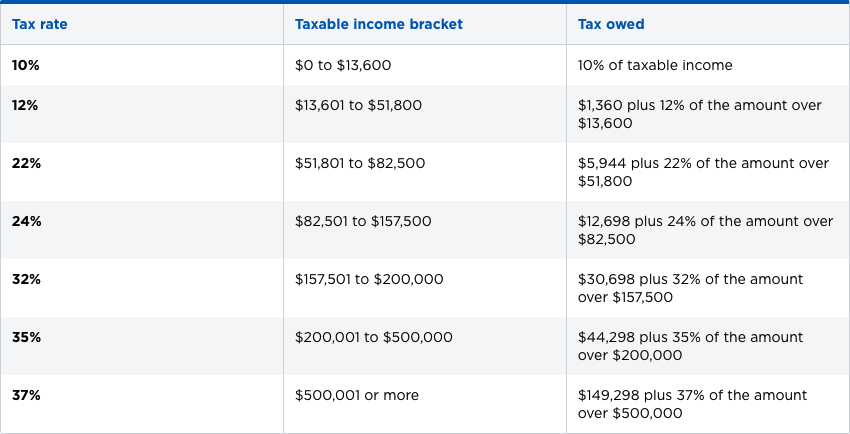

The Internal Revenue Service IRS is responsible for publishing the latest Tax Tables each year rates are typically published in 4 th quarter of the year proceeding the new tax year. Your household income location filing status and number of personal exemptions. This page provides detail of the Federal Tax Tables for 2019 has links to historic Federal Tax Tables which are used within the 2019 Federal Tax Calculator and has supporting links to each set of state.

Tax Bulletins usually clarify the application of existing laws and regulations to new or disputed circumstances but for the second time in as many years Pennsylvanias Department of Revenue arguably went further adopting new nexus standards for corporate income tax purposes in a bulletin. For example Hawaii has a top tax rate of 11 and 12 income brackets while Iowa has a top tax rate of 853 and nine income brackets. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Is not a state but it has its own income tax rate. Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in Missouri for single.

The 2021 form continues to have AGI on line 11. The Salary Calculator for US Salary Tax Calculator 202223 - Federal and State Tax Calculations with full payroll deductions tax credits and allowances for 2022 and 2021 with detailed updates and supporting tax tables. Many state pages also provide direct links to selected income tax return forms and other resources.

The Federal Tax Calculator below is updated for the 202223 tax year and is designed for online calculations including income tax with Personal allowance refundable non-refundable tax credits Federal Tax State Tax Medicare Social Security and Yearly Income Tax deductions we also have State Tax calculators available for each state. Return Filing and Payment Changes. The action has left some policymakers and practitioners perplexed.

Get HR Block 2019 Back Editions tax software federal or state editions for 2019. Both Missouris tax brackets and the associated tax rates were last changed two years prior to 2020 in 2018. There are only seven states nationwide that dint collect a state income tax - however when a state has no income tax it generally makes up for lost tax.

If you received a Tax Correction Notice due to an adjustment of the withholding amount you reported click here for more information. Those states have reciprocity agreements with Illinois. Other states have a top tax rate but not all states have the same number of income brackets leading up to the top rate.

Both Texas tax brackets and the associated tax rates have not been changed since at least 2001. Massachusetts Department of Revenue issues most refunds within 21 business days. Iowa Kentucky and Michigan.

How Income Taxes Are Calculated.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Quarterly Tax Calculator Calculate Estimated Taxes

Delaware Taxes De State Income Tax Calculator Community Tax

Where S My Iowa State Tax Refund Taxact Blog

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Irs State Tax Calculator 2005 2022

How The Tcja Tax Law Affects Your Personal Finances

Federal Income Tax Brackets Brilliant Tax

2019 State Income Tax Rates Credit Karma Tax

Federal Income Tax Brackets Brilliant Tax

Income Tax Calculator 2021 2022 Estimate Return Refund

Llc Tax Calculator Definitive Small Business Tax Estimator

Hawaii Income Tax Hi State Tax Calculator Community Tax

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube